Complete the “International Financial Reporting Diploma (IFRD)” final level paper of the CPA syllabus, and earn direct membership with CPA UK from Bangladesh.

| IFRD Batch 4 – January 2026 Intake Admission Going On! Class Starts 18th January 2026 Via Zoom | |

| Contact Course Co-Ordinator |  |

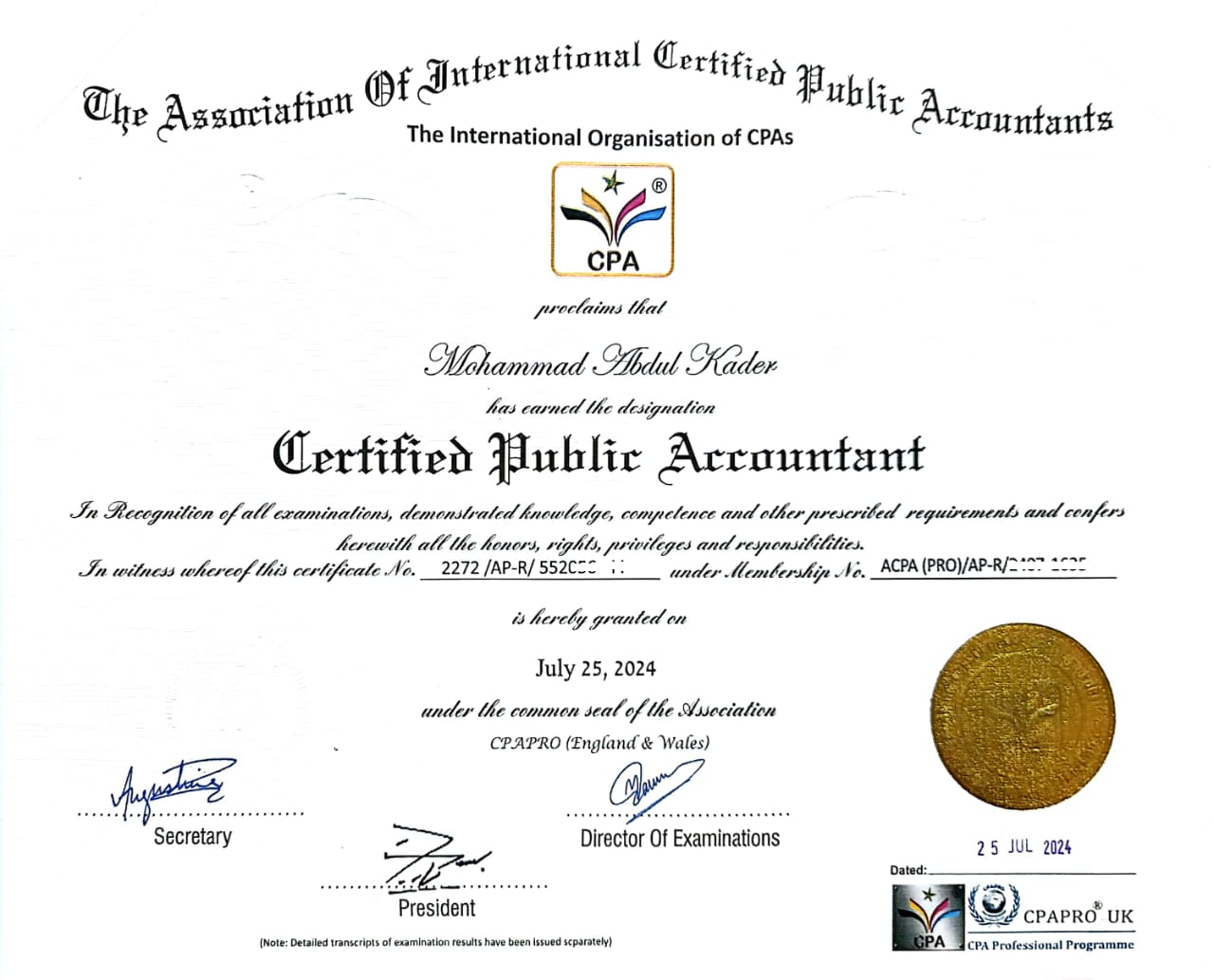

| Course Objective | Participants who complete the International Financial Reporting Diploma (IFRD) paper in the ADBA model (Final Level of CPA Syllabus) will be granted exemptions for the first two levels: Certified Business Technician (CBT) and Professional Business Accountant (PBA). Upon completing the IFRD paper, participants will be eligible to apply for direct non-practicing membership with the Certified Public Accountant (UK). |

| Eligibility | To join the “International Financial Reporting Diploma (IFRD) program”, the progressive pathway of CPA (UK), you need to meet the following eligibility requirements: ❑ Hold a graduate degree in commerce. ❑ Must have at least 10 years of relevant job experience, including the CA articleship period. |

| Module 1 | Global Financial Reporting Frameworks (6 class) | ❑ IAS 1: Presentation of Financial Statements (IFRS 18) ❑ IAS 2: Inventories ❑ IAS 12: Deferred Tax ❑ IFRS 15: Contract on Sales ❑ IAS 16: Property, Plant and Equipment ❑ IFRS 16: Leases ❑ IAS 37: Provisions, Contingent Liabilities, and Contingent Assets ❑ IAS 38: Intangible Assets ❑ IAS 8: Accounting Policies, Changes in Accounting Estimates and Errors |

| Module 2 | External Audit & Risk Management Practices (2 class) | ❑ Introduction to External Audit and Risk Management ❑ Understanding Audit Risk ❑ Fraud Detection and Risk ❑ Emerging Trends and Future of Auditing Risk Management |

| Module 3 | Corporate Governance & Ethical Leadership (2 class) | ❑ Introduction to Corporate Governance ❑ Frameworks and Codes of Corporate Governance ❑ The Role of the Board of Directors ❑ Corporate Social Responsibility (CSR) and Ethical Governance ❑ Risk Management and Internal Controls ❑ Emerging Trends in Corporate Governance |

| Class Mode | Exam Format | Duration | CPD Credit | IFRD Course & Exam Fee | CPA (UK) Membership Fee |

|---|---|---|---|---|---|

| Hybrid (Live Zoom sessions and in-class learning) | MCQ (100 Marks) | 3 Months | 20 Hour | Tk 35,000/- (Payable to AFMA) | GBP 350 (Regular GBP 650) (Payable to CPA) |

| Upon completing thiscourse, you will be eligible to earn the prestigious “Certified Public Accountant (CPA)”certification directly and become a proud member of the esteemed CPA Professional (UK). | |

| With your IFRD qualification, you can get accelerated pathway & exemption with the Chartered Institute of Management Accountants (CIMA, UK). | |

| With your IFRD qualification, you can apply for membership and certification with the Registered Public Accountant, Canada. |

| This course is accredited by CPD Accreditation Office, UK. Yu will get a complementary CPD Certificate along with IFRD. |

|  |

|  |

Mr. Hasan Istiaque Mahmud

Business Development Manager,

Accounts, Finance & Risk Management Courses,

AFMA Bangladesh

| +880 1318 57 41 51 | |

| istiaque.afmalearning@gmail.com | |

| facebook.com/afmaglobal | |

| linkedin.com/company/afmabangladesh/ | |

| Bangladesh Office: House 32-34, Level 05, Road 7, Block C, Niketan R/A, Gulshan 1, Dhaka 1212 |