This program aims to equip professionals from development organizations in the public, private as well as not-for-profit sectors with the knowledge and skills required for the efficient mobilization of zakat funds and their effective allocation as an “alternative” source of financing. It also seeks to build a cadre of zakat professionals, given a steady increase in the demand for personnel well-versed in shariah rules and managerial competencies to serve the development sector.

This program is open to all Muslim/non-Muslim participants who are interested to know/learning more about zakat and zakat management as per Shariah guidelines.

| 1 | Introduction to Zakat |

| 2 | Shariah underpinning |

| 3 | Zakat calculation |

| 4 | Zakatable assets |

| 5 | Deductible liabilities |

| 6 | Zakat on business |

| 7 | Shariah underlying distribution |

| 8 | Distribution process |

| 9 | Case studies – how to calculate |

Online

Live Class

No Of Classes: 6

CPD Credit:

8 Hour

No Of Exams:

1 Exam (MCQ + Case Study)

The Pass Mark Is 50%

Duration:

1.5 Months

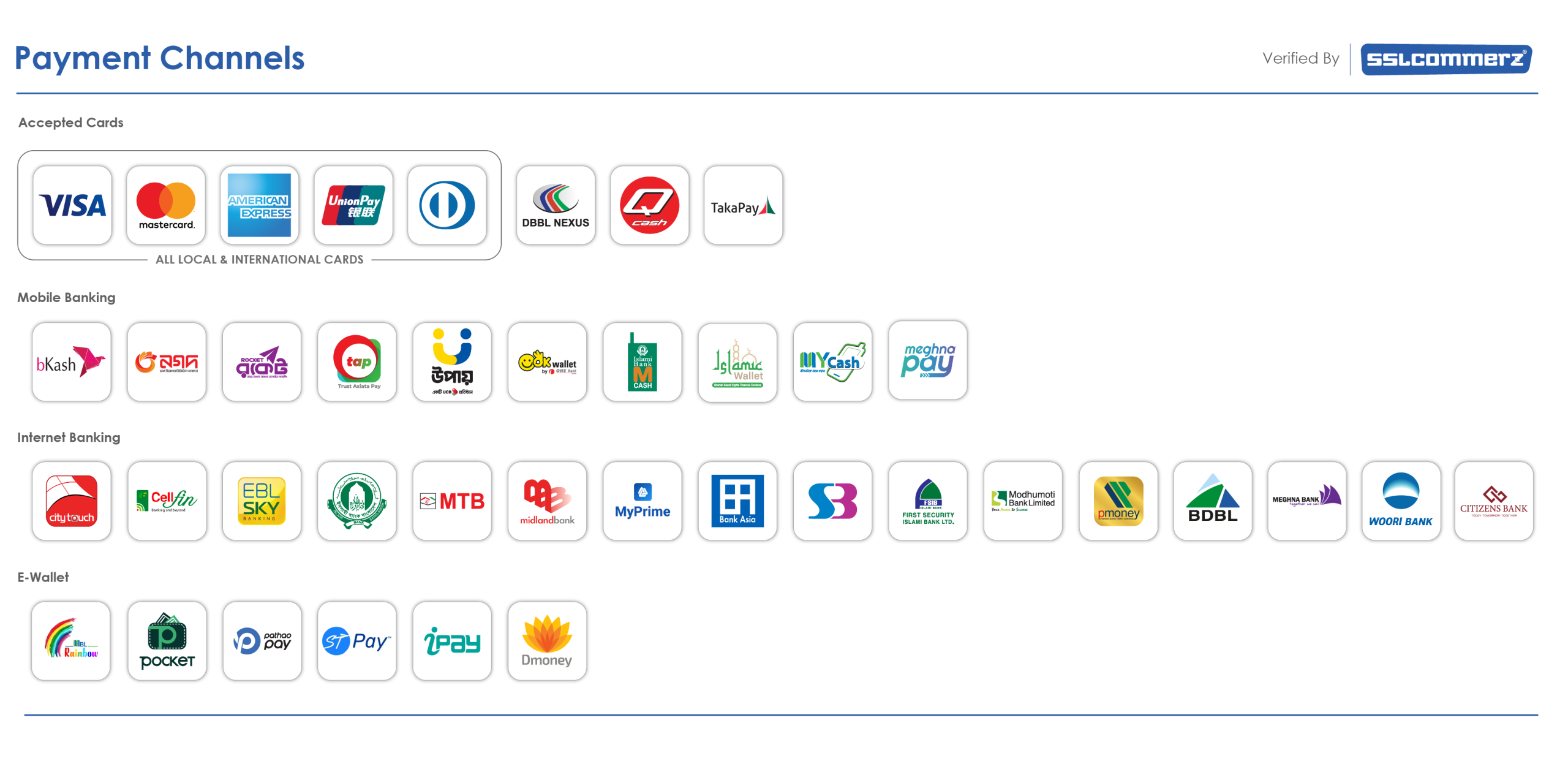

Course Fee:

Tk. 2,950 only.

After completing the course, you will receive a certificate from the Institute of Strategic Management & Finance (ISMF) in the USA. Additionally, this course is accredited by the International Institute of Islamic Economics & Finance in the UK

Contact for PDZM Programme

|  |  | |

| +88 01318-574151 | https://www.facebook.com/afmaglobal | https://m.me/afmaglobal/ | afmalearning.info@gmail.com |