| Course Objective | The Certified Fraud and Forensic Professional (CFFP) certification is designed to help senior managers, managers, auditors, and accountants create value for their respective organizations. No business is safe. Globally white-collar crime increasing significantly no matter which country you are from. Fraud, contractual disputes, and allegations of corruption require expert examination of books and records, agreements, and documentation to determine what actually occurred. |

| Eligibility | The CFFP course is suitable for individuals with a background in Accounting, Finance, Banking, or related fields who wish to advance their careers within their organization. Additionally, professionals who are interested in gaining knowledge about Fraud and Forensic Accounting can also benefit from this program. |

| CFFP Covers | The course covers a wide range of topics, including fraud detection and prevention, forensic accounting techniques, legal and regulatory frameworks, and investigative procedures. Students will learn how to identify and investigate financial fraud, analyze financial statements, and present their findings in a clear and concise manner. The course also covers the use of technology in fraud detection and prevention, including data analytics and digital forensics. |

| Benefits After Completion | After successfully completing this course, participants will get the prestigious Certified Fraud and Forensic Professional (CFFP) certification and become a proud member of the esteemed Institute of Strategic Management & Finance (ISMF), USA. But wait, there’s more! With your CFFP qualification, you can also apply for membership and certification of the Institute of Certified Forensic Accountants® at an exclusive discounted rate for the Certified Professional Forensic Accountant OR Certified Fraud Specialist certification. |

| Fraud and Forensic Accounting Module | 1. Introduction to Forensic Accounting 2. Forensic Psychology 3. Fraud 4. Why do people commit fraud? 5. Psychology of Fraudster 6. The accidental fraudster 7. Predator fraudster 8. Data technology 9. Money Laundering 10. Whistleblowing 11. Case Study: WorldCom, Enron |

| Class Mode | Exam | Duration | Number of Classes | CPD Credit | Course Fee |

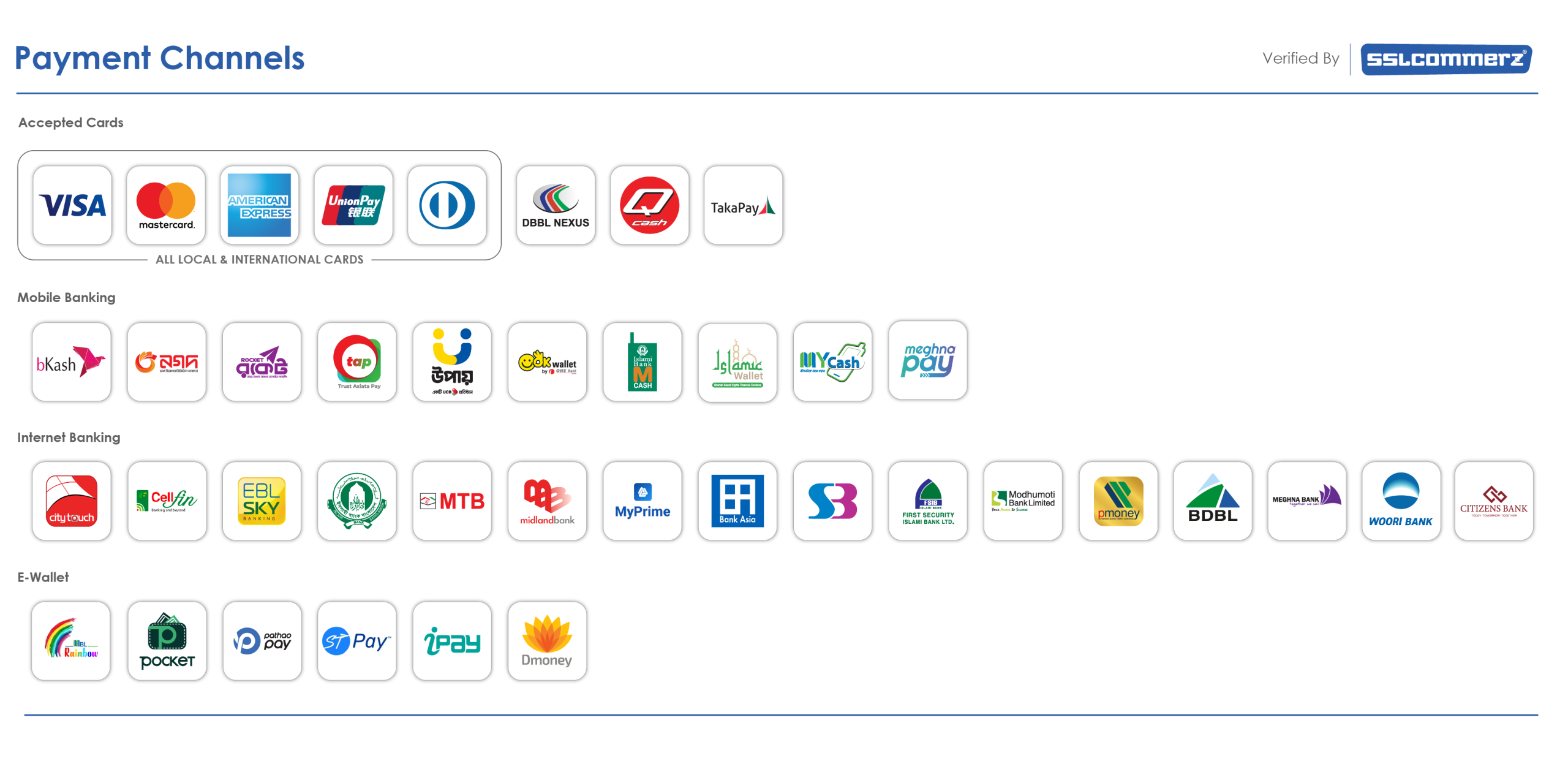

| Pre-Recorded Sessions | Online MCQ (100 Marks) | 2 Months | 35 Recorded lesson video | 12 | Tk. 12,000 (Including Course, Exam, Certification Fee) |

After successfully completing this course, participants will get the prestigious Certified Fraud and Forensic Professional (CFFP) certification and become a proud member of the esteemed Institute of Strategic Management & Finance (ISMF), USA. |  |

| But wait, there’s more! With your CFFP qualification, you can also apply for membership and certification of the Institute of Certified Forensic Accountants® at an exclusive discounted rate for the Certified Professional Forensic Accountant OR Certified Fraud Specialist certification.  |  |

| Wait, there’s more! With your CFFP qualification, you can also apply for membership and certification of the Institute of Certified Forensic Accountants® at an exclusive discounted rate for the Certified Fraud Specialist certification.  |  |

Mr. Muhammad Mustasim

Business Development Manager,

University & Forensic Accounting Program

AFMA Bangladesh

| +880 1742 827 823 | |

| afmabangladesh@gmail.com | |

| facebook.com/afmabd | |

| linkedin.com/company/afmabangladesh/ | |

| Bangladesh Office: House 32-34, Level 05, Road 7, Block C, Niketan R/A, Gulshan 1, Dhaka 1212 |