| Brief History | Since 2022, AAP has globalized its CAA certification by appointing tuition providers worldwide. To enroll, register with us for the examination. Our providers offer syllabus-aligned classes, providing a minimum of 25 hours of study through online or offline methods. After completion, take the online exam with us, available on the third week of every Friday, Saturday, and Sunday. |

| Introduction | The CAA Programme, administered by AAP (The Association of Accounting Professionals), is renowned in the UK for financial and risk management, as well as business analysis. CAA certification demonstrates mastery of financial accounting management, relevant IAS/IFRS knowledge, and adherence to AAP’s core values and ethics. |

| Requirements to become a Qualified CAA | a) High School Degree OR Graduation in any discipline; b) A minimum of 25 hours of approved accounting management training c) A passing score (50%) on the CAA Final Examination. |

| AAP CAA Recertification | After passing the CAA exam, staying updated on accounting practices is essential. Instead of a membership fee, attend our “certificate of proficiency” sessions twice a year. Authorized providers conduct these sessions, and we issue certificates. Failure to attend necessitates a recertification exam every five years. |

| CAT from IAT USA This course is accredited by the Institute of Accounting Technician, USA. After CAA certification, you will have the opportunity to become a Certified Accounting Technician (CAT) member of this institute. |

| CAT from ISMF USA This course is accredited by the Institute of Strategic Management and Finance (ISMF), USA. Upon completion of the CAA certification, you will be eligible to obtain the Certified Accounting Technician (CAT) designation from the institute. | |

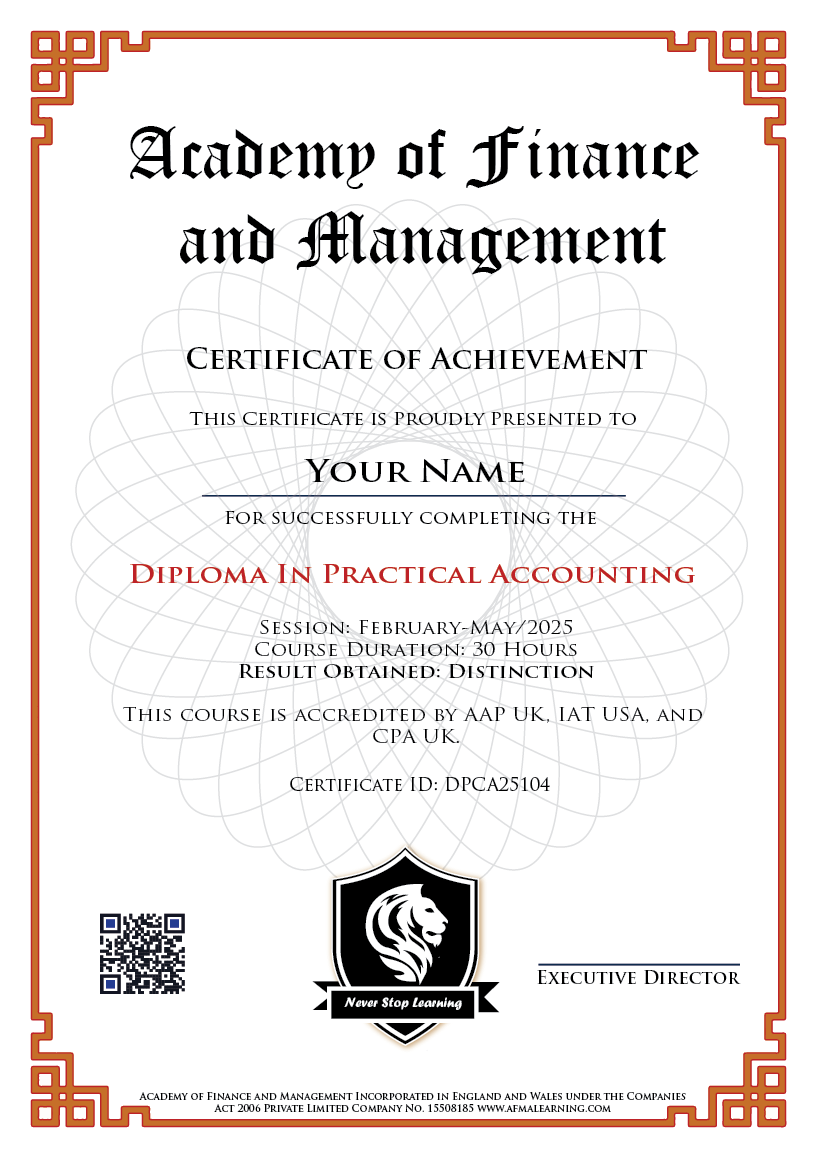

| Diploma in Practical Accounting from AFMA UK After successfully completing the CAA program, you become eligible to receive the Diploma in Practical Accounting from AFMA UK. |

| Module 1: | Fundamentals of Business and Organization Structure | Explore the foundational concepts of business structure and development, from initial ideas to forming a corporate entity. |

| Module 2: | Fundamentals of Financial Accounting | Learn the basic principles of accounting, including the accounting cycle, journal entries, and preparation of core financial statements. |

| Module 3: | Cost and Management Accounting | Understand cost classifications, budgeting techniques, break-even analysis, and tools for effective managerial decision-making. |

| Module 4: | Business Taxation and Compliance in Bangladesh | Gain an overview of VAT, income tax regulations, and compliance requirements specific to businesses operating in Bangladesh. |

| Module 5: | Corporate Laws and Governance | Study essential company laws, business registration processes, roles of regulatory authorities, and principles of corporate governance. |

| Module 6: | Financial Analysis and Reporting | Develop skills in analyzing financial statements using ratio and trend analysis, and learn to prepare financial reports that support business decisions. |

| Module 7: | Auditing and Internal Controls | Introduction to auditing concepts, types of audits, internal control systems, and methods to identify and prevent errors or fraudulent activities. |

| Module 8: | Corporate Etiquette and Professionalism | Understand workplace ethics, communication standards, and professional behavior expected in corporate environments. |

| Exam Format | The CAA examination is a closed-book, two-hour test consisting of 80 multiple-choice questions. You can take the exam from your residence using your computer. For any inquiries, please email to AAP at office@aaccp-uk.org |

| ONLINE Exam Process | The CAA examination is a closed-book, two-hour test with 100 multiple-choice questions. The exam can be taken from your home using your computer. We trust that our professional candidates will not refer to any books or search engines during the exam. In case the system suspects any unfair behavior, the laptop’s camera will be activated immediately. If you refuse to allow the camera activation, your result may be withheld. |

| Steps of the Exam | 1. The day before the exam, you will receive an email from us containing the exam link. 2. The exam link will be activated at 8:00 AM (local time) on the exam day and will remain open for 24 hours. 3. You should take the exam for 2 continuous hours on that day at your preferred time. 4. Once you click the link, it will automatically time out after 2 hours. 5. You are allowed to join the exam only once, so make sure not to click unnecessarily. 6. Exam results are published instantly immediately after submission of the exam. Results are not publicly posted on the website for confidentiality reasons. 7. If a participant fails the exam, they can retake it on the next available date by confirming via email. The second exam is free of charge, but from the third attempt onwards, an exam fee of GBP 50 (Tk 7,500) will apply. |

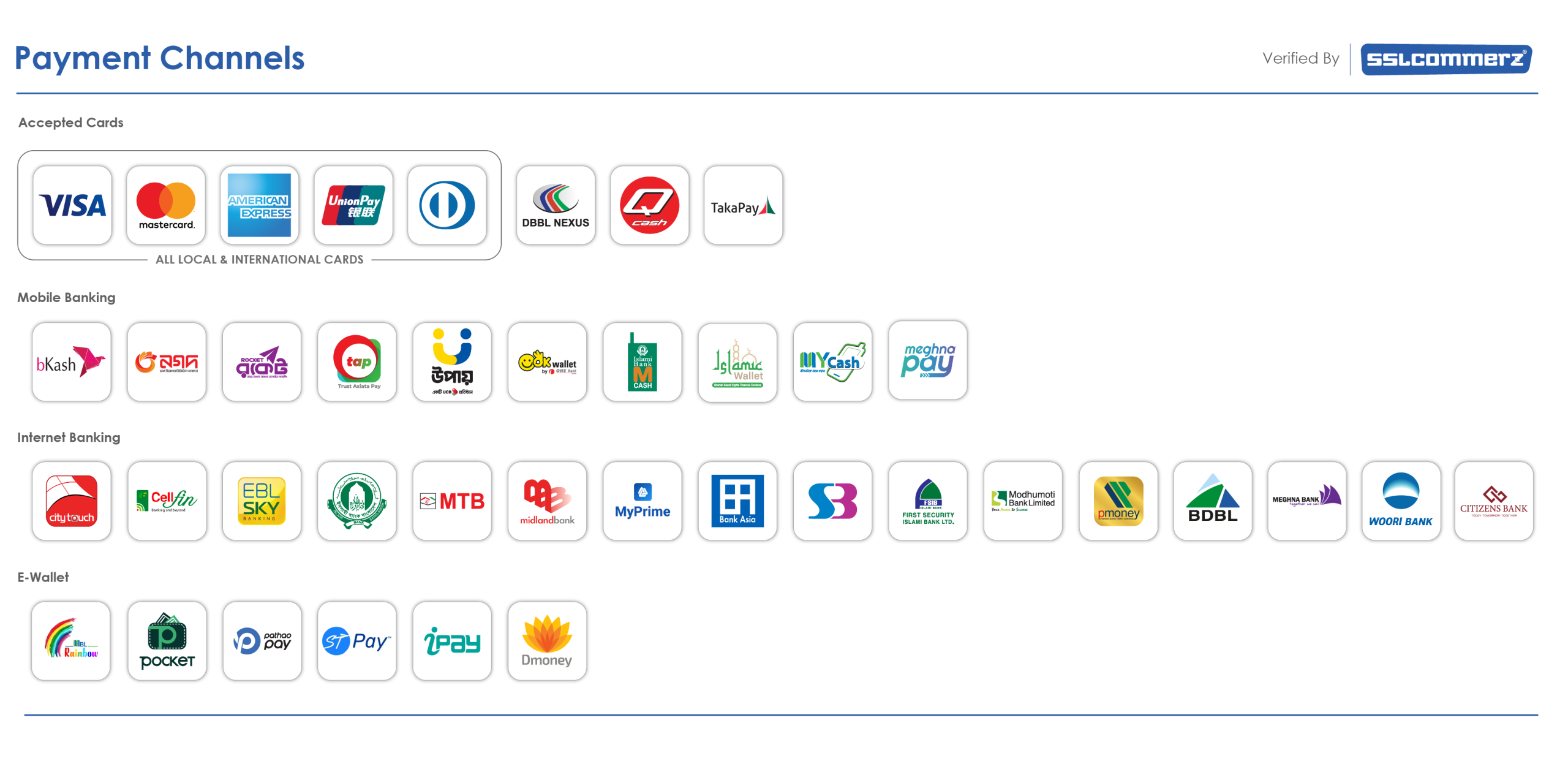

| a) CAA Fee: (Registration Fee, Exam Fee, Certification Fee) | 🎓 Students or Job Seekers – BDT 12,000 Only (Must submit valid Student ID) 👔 Employed Professionals – BDT 18,000 Only |

[buy_now id=”4590″ label=”Buy Now – Student BDT 12,000″]

[buy_now id=”4591″ label=”Buy Now – Professional BDT 18,000″]

📌 Note: Submission of a valid ID card is mandatory to verify your category.

| Class Mode | Assessment | Course Duration | Fee for Students or Job Seekers | Fee for Employed Professionals |

| Live zoom & Class room sessions | 1 Final Exam (MCQ) | 3 Months | BDT 12,000 Only (Must submit valid Student ID) | – BDT 18,000 Only |

|  |

|  |

Mr. Hasan Istiaque Mahmud

Business Development Manager,

Accounts Finance & Risk Management Courses,

AFMA Bangladesh

| +880 1318 57 41 51 | |

| istiaque.afmalearning@gmail.com | |

| facebook.com/afmaglobal | |

| linkedin.com/company/afmabangladesh/ | |

| Bangladesh Office: House 32-34, Level 05, Road 7, Block C, Niketan R/A, Gulshan 1, Dhaka 1212 |